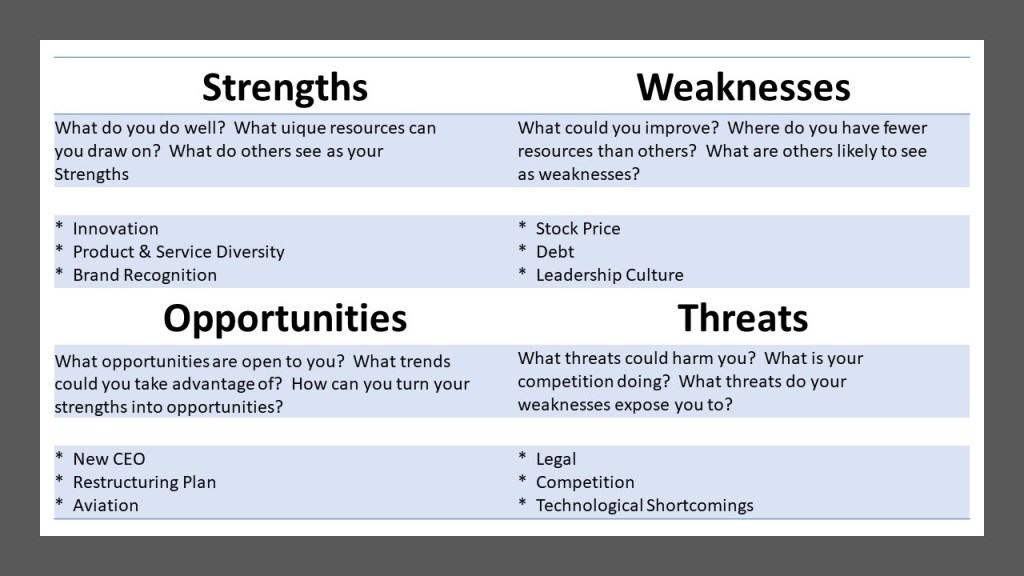

Strengths

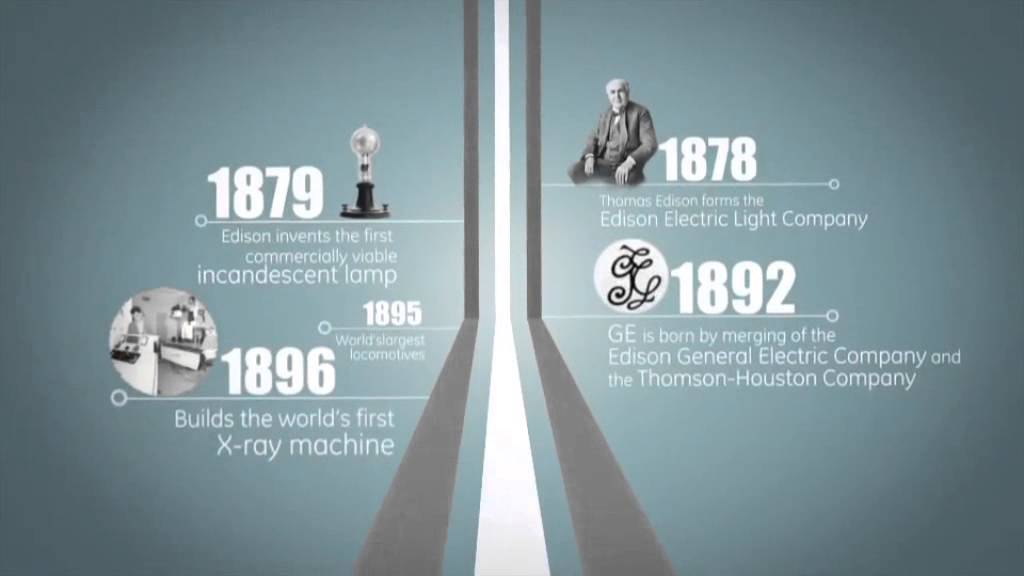

(Innovation) – General Electric is a company with a strong foundation dedicated towards innovation and new technology. Matter of fact, GE was founded by inventors that were ahead of their time. “The original version of GE was founded by Thomas Edison himself, who ran the firm then later worked as an inventor and researcher in its labs. This company marketed the first light bulb, the vacuum tubes for the first TVs and experimented with America’s first jet engine.” (Reed, 2018) A lot has changed since GE’s inception. New technology and dedication towards innovative design and manufacturing have been a focul point of the company. “Inspired by four decades of U.S. Army rotorcraft experience, GE responded to this need by designing the new T901. Building on an unparalleled record with the U.S. Army’s Apache and Black Hawk helicopters, the T901 meets all ITEP requirements with fewer parts, a simpler design, and proven, reliable technology. GE stands ready to take the U.S. Army into the future of rotorcraft aviation.” (General Electric, 2019)

(Product & Service Diversity) – It’s a fact that General Electric has a future business model that includes divestures of various business segments (discussed further in the opportunities section of this analysis). However, GE still has a very diverse product and services portfolio. John Flannery (past CEO) made a comment that “we (GE) are aggressively driving forward as an aviation, power and renewable energy company – three highly complementary businesses poised for the future.” (Kim, 2018) GE also has business segments in areas such as oil & gas, healthcare, transportation, lighting, and capital.

(Brand Recognition) – GE’s brand recognition is one of their strongest strengths. It really does not take much research or analysis to emphasize this point of view. As a way to validate this, I thought it would be interesting to identify GE brand products within my own home. After a brief walk around, below are a few items that I found with the GE logo.

In addition, the company that I work for (Doyon Utilities) owns and operates a power plant largely made up of GE power generation equipment and components. GE’s “We bring good things to life” is a historic and trendy slogan that many people are familiar with to this day.

Weaknesses

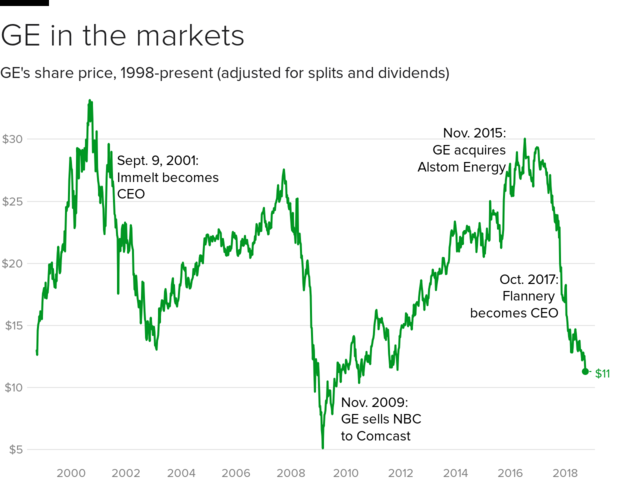

(Stock Prices & Debt) – General Electric’s stock price as of September 20th, 2019, was $9.37 per share. In 2016, GE stock prices hovered around $30 and have been on a steady decline ever since. “So, from a valuation standpoint, GE — even after it’s 75% stock price slide over the past three years — doesn’t look like much of a bargain.” (Bromels, 2018) GE’s overall value is considered one of their weaknesses because it hinders investment which leads to future uncertainty. GE’s total assets dropped from approximately $800B in 2009 to $312B in 2019. This is a huge reduction especially when compared to GE’s current total liabilities of $212B ($92B long-term debt). Some market analysts are optimistic that GE’s financial outlook will improve. However, until this actually happens, I would consider this a weakness as it pertains to this SWOT analysis.

(Leadership Culture) – GE was a organization that once set out to expand and grow it’s business at any cost. This typically meant that GE’s top leadership team was focused more on bottom-line results than employee development. Jack Welch served as GE’s CEO for almost 20 years starting back in 1981. Welch’s “fix it, close it or sell it was a favorite slogan. Welch wanted to get out of any businesses where GE wasn’t a market leader.” (Gryta & Mann, 2018) “While it’s true that Welch presided over a period of unprecedented growth, he also created a dog-eat-dog culture.” (Davis, 2018) In recent years, GE underwent new leadership. Jeffrey Immelt replaced Jack Welch as GE’s CEO until his recent retirement in 2017. “Immelt claims that he continued to promote a culture of debate and external competitiveness. But people who worked there say that there was just as much competitiveness inside the walls of GE, and that, to be successful, you could never let anyone see you sweat.” (Davis, 2018) GE’s leadership culture has been hard pressed with a nose to the grind stone mentality for nearly forty years. This has allowed for GE to overlook internal management struggles that ultimately resulted in a weak leadership culture.

Opportunities

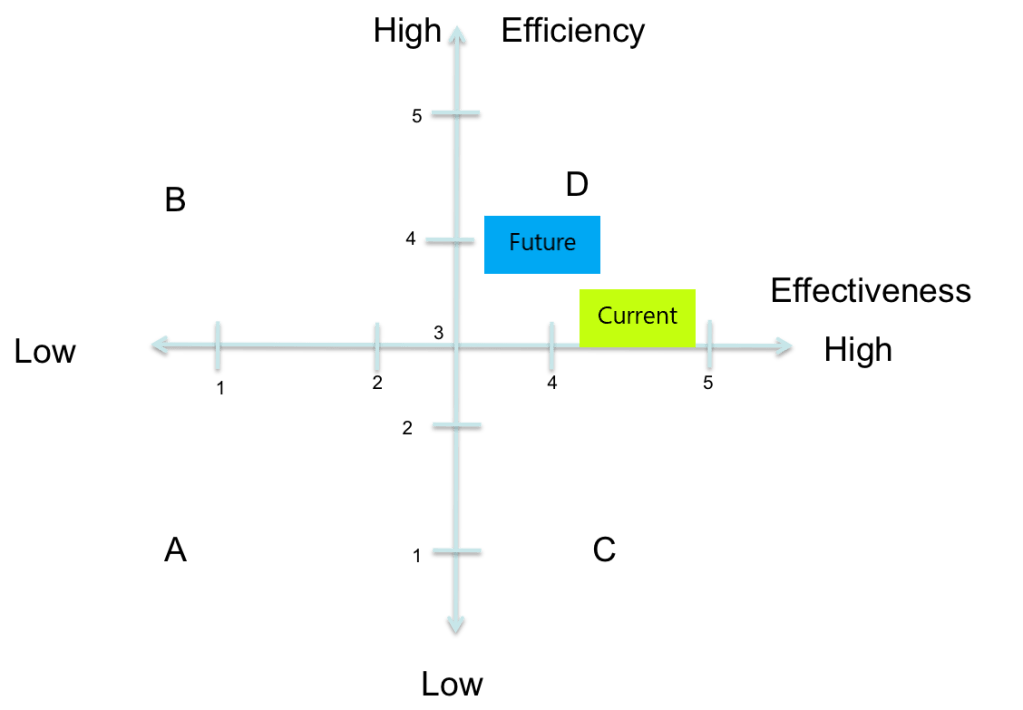

(New CEO) – GE’s new CEO, Larry Culp, could be a breath of fresh air for the organization. Along with GE’s focus towards effectiveness, there is also now an opportunity to run a more efficient business. “Right now, GE needs to execute better, and improve the productivity and cash flow from its existing assets. Fortunately, this is exactly the kind of strategy that Culp’s tenure at Danaher suggests he’s highly qualified to deliver.” (Samaha, 2018) Culp, who is an outsider to GE, has proven to be a more “hands on” leader which is a step in the right direction compared to previous leadership. “In his previous life at the much smaller Danaher, Culp was known for immersing himself in its various companies. Rather than bringing executives to headquarters for reviews, he would travel to their offices and walk the factory floors.” (Gryta & Mann, 2018)

(Restructuring Plan) – Rather than the older GE strategy centered around growth, GE plans to focus more on their core businesses. GE leadership and stakeholders feel that focusing on a simpler portfolio would be beneficial for future sustainability. “We (GE) will now move forward with purpose to make our company simpler and stronger and accelerate growth across our businesses. I’m confident that today’s actions, in conjunction with other changes we have already made, will produce improved operating results and increased shareholder value going forward.” (Kim, 2018) GE also plans on minimizing corporate costs as part of the their restructuring plan. “GE’s restructuring plan involves stripping down the company to three main businesses: power, aviation, and renewable energy. Here GE has an opportunity to significantly cut corporate costs, and focus on improving productivity in the remaining businesses.” (Samaha, 2018).

(Aviation) – GE has a stronghold on the aviation industry, worldwide. Business opportunities with manufacturers such as Boeing and Airbus have propelled GE’s future in the aviation industry. In reference to Boeing and Airbus, “The two aircraft are set to dominate the narrow-body market for years to come, and GE has a great opportunity to profit from servicing the LEAP engine in the long term.” (Samaha, 2018) GE offers a vast number of products and services within their aviation segment. They also support both commercial and military aviation markets allowing for a broader network of business opportunities. “GE aviation continues to be a leader in the aviation industry. GE technology powers two out of every three commercial departures around the world and GE’s global installed base includes more than 65,000 engines. (Kim, 2018)

Threats

(Legal) – GE has recently been accused of financial fraud and market manipulation. Harry Markopolos, a financial advisor and financial fraud investigator has accused GE of various fraudulent activities. “Markopolos dropped a 175-page report alleging all sorts of fraud and misrepresentations at GE.” (Bezek, 2019) GE’s stock was impacted as this caused uncertainty to GE’s investors. As more analysis is performed by outside entities, it appears that Markopolos was not completely accurate and errors were identified in his report. Regardless, this type of attention towards GE can only have a negative impact and be seen as a substantial threat. “GE operates at the highest level of integrity and stands behind its financial reporting, the company said in a statement. We remain focused on running our businesses every day, following the strategic path we have laid out.” (CBS, 2019)

(Competition & Technological Shortcomings) – What appears to be one of GE’s major opportunities could also be a threat to the organization. The aviation industry is highly competitive and is clearly a realm that GE dominates. However, technological shortcomings could make a huge difference on relationships with aircraft manufacturers thus allowing competitors to make a presence. “Boeing has become a potentially larger issue for GE’s turnaround plans and not only because the airplane maker’s troubled 737 MAX jet is still grounded. Boeing said in June that it had pushed back flight plans for its newest 777 model because GE9X engine issues discovered during testing. The GE9X, which powers the new 777 planes, is the most powerful aircraft engine GE has built.” (Root, 2019) GE leadership is optimistic that these type of technical issues will be resolved and mitigated. In addition to technological shortcomings, GE aviation is also threatened by other competitors that have successful R&D programs. For example, Pratt & Whitney and Rolls Royce both offer comparable engine technologies similar to GE. “Pratt and Whitney built all the engines for the Air Force’s F-22 fighter, and now it’s building all the engines for the tri-service F-35 fighter.” (Thompson, 2018)

References

New beginning, (2019, September 21). Retrieved from General Electric: https://www.geaviation.com/military/engines/t901-turboshaft-engine

Bezek, I. (2019, September 11). General Electric is a buy despite the Markopolas Report. Retrieved from Investor Place: https://investorplace.com/2019/09/general-electric-is-a-buy-despite-the-markopolos-report/

Bromels, J. (2018, November 28). General Electric: What the bulls are missing. Retrieved from the Motley Fool: https://www.fool.com/investing/2018/11/28/general-electric-the-bull-case-from-a-bear.aspx

CBS/AP. (2019, August 16). General Electric accused of fraud “bigger than Enron” by Madoff whistleblower. Retrieved from CBS News: https://www.cbsnews.com/news/general-electric-accounting-fraud-bigger-than-enron-alleged-by-madoff-whistleblower/

Davis, A. (2018, February 22). 3 lessons every leader can learn from GE’s downfall. Retrieved from INC.com: https://www.inc.com/alison-davis/3-lessons-every-leader-can-learn-from-ges-downfall.html

Gryta, T. & Mann, T. (2018, December 14). GE powered the American Century-Then it burned out. Retrieved from the Wall Street Journal: https://www.wsj.com/articles/ge-powered-the-american-centurythen-it-burned-out-11544796010

Kim, T. (2018, June 26). Retrieved from CNBC: GE shares pop after it reveals plan to spin off health-care unit, post best day in 3 years. https://www.cnbc.com/2018/06/26/ge-shares-rise-after-it-announces-plan-to-spin-off-health-care-unit.html

Reed, E. (2018, November 27). General Electric’s history and what to expect in 2019. Retrieved from TheStreet: https://www.thestreet.com/markets/general-electric-history-future-14791857

Root, A. (2019, August 1). GE CEO Larry Culp on the Company’s Turnaround,Boeing, and China. Retrieved from the Barron’s: https://www.barrons.com/articles/general-electric-ceo-larry-culp-speaks-out-on-the-turnaround-china-and-boeing-51564588114

Samaha, L. (2018, September 9). 3 big opportunities for General Electric. Retrieved from the Motley Fool: https://www.fool.com/investing/2018/09/09/3-big-opportuniites-for-general-electric.aspx

Samaha, L. (2018, November 26). What GE investors can expect from new CEO Larry Culp. Retrieved from the Motley Fool: https://www.fool.com/investing/2018/11/26/new-ge-ceo-larry-culp-what-investors-can-expect.aspx

Thompson, L. (2018, July 2). The big threat to GE Aviation isn’t corporate breakup — It’s a resurgent Pratt & Whitney. Retrieved from Forbes: https://www.forbes.com/sites/lorenthompson/2018/07/02/the-big-threat-to-ge-aviation-isnt-corporate-breakup-its-a-resurgent-pratt-whitney